Overcoming barriers to African vaccine manufacturing

By Guy Pickles, Head of Vaccines, MedAccess

24 April 2025 | Insight

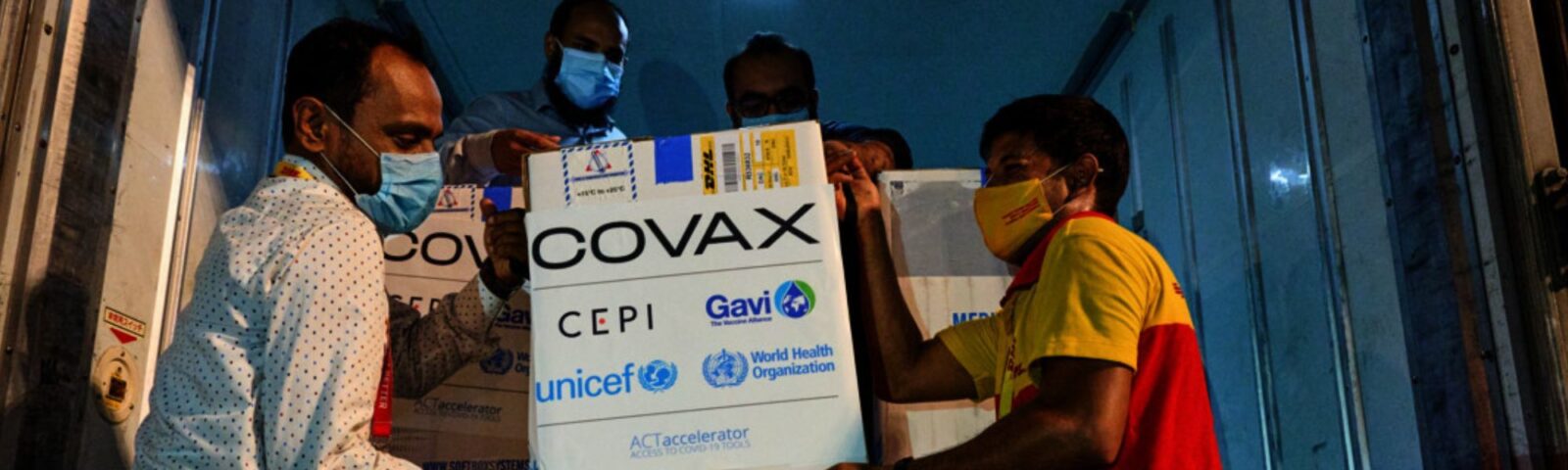

The COVID-19 pandemic exposed significant vulnerabilities in global vaccine supply chains, particularly for African nations. With over 25% of the world’s vaccines being procured and delivered in Africa, yet less than 1% being produced on the continent, the need for regional manufacturing has never been more apparent. This imbalance not only affects routine immunisation programmes but also poses a severe risk to health security during pandemics and other disease outbreaks.

Progress and developments

In recent years, there has been a substantial shift towards enhancing Africa’s capacity to produce vaccines. Numerous projects have been initiated, funded, and advanced, including tech transfers and the construction of new facilities the continent. One such example is BioNTech’s modular BioNTainers – shipping container sized facilities for manufacturing African-produced mRNA vaccines.

Another notable initiative is the $1 billion African Vaccine Manufacturing Accelerator (AVMA). Spearheaded by Gavi, the Vaccine Alliance, AVMA is designed to address critical gaps in vaccine manufacturing in Africa. The initiative offers financial incentives to vaccine manufacturers in Africa who achieve key regulatory milestones and supply priority vaccines to countries in Africa. These incentives are intended to de-risk investments and encourage technology transfers, contributing to the establishment of new local manufacturing facilities. Thanks to these market developments, at least nine vaccines from African vaccine manufacturers are anticipated to enter the market by 2030.

Barriers to entry

Despite the progress, several barriers continue to hinder regional vaccine manufacturing in Africa. Vaccine production involves complex biological processes governed by stringent regulatory requirements, which has historically led to a concentration of vaccine development and manufacturing capacity in a few regions worldwide. In Africa, many countries’ National Regulatory Authorities lack the WHO ‘Maturity Level 3’ standard required to allow WHO endorsement of domestically manufactured vaccines. The absence of R&D capacity for drug substance and a skills shortage in the regional biotechnology workforce further complicate the situation.

Additionally, transitioning to African-produced vaccine may come with higher initial costs compared to current supply agreements with multinational manufacturers whose established market share means they can offer more competitive prices.

However, investing in regional manufacturing is a strategic move towards long-term sustainability and self-reliance, ultimately strengthening health security and economic resilience on the continent.

Current challenges

Three primary challenges to accelerating the impact of African vaccine manufacturers were highlighted at the African Vaccine Manufacturers Forum in Cairo earlier this year:

- Demand visibility: Political commitment from African countries’ Ministries of Health and Ministries of Finance to purchase locally produced vaccines is crucial. Additionally, procurement agents like UNICEF and the African Union should provide clear volume allocation targets. Providing visibility into national immunisation priorities and procurement targets will help de-risk investments and demonstrate a viable market for manufacturers to enter.

- Regulatory streamlining: Despite progress, the regulatory environment requires further development to support accelerated access to Africa manufactured vaccines. Streamlining the World Health Organization’s Prequalification (PQ) processes with national regulatory approvals can reduce delays and facilitate faster market entry for new vaccines. Enhancing the maturity level of National Regulatory Authorities (NRAs) in African countries is also essential.

- Funding and financing: Bridging the gap between tech transfers and regulatory approval milestones is critical. This period requires substantial investment in bioequivalence studies, equipment, and facility preparation. Organisations like MedAccess are exploring innovative financing solutions specifically to bridge this gap, alongside activities that will help to build markets for offtake of approved, finished products.

Innovative solutions and future outlook

The unique market challenges faced by African vaccine manufacturers require bespoke financing tools and partnerships. MedAccess, for instance, is exploring various financial instruments such as volume guarantees and loan guarantees to share the market risks and accelerate progress. This would give manufacturers confidence to produce at scale and enter African markets, particularly in middle-income countries that do not receive support from Gavi, where vaccines can cost many times what Gavi-eligible countries pay. Close collaboration with manufacturers, funders, and procurers is vital to align incentives and ensure the success of these initiatives.

Progress so far is promising, but it is crucial to build a track record of successful models for the first wave of products. Demonstrating the feasibility and sustainability of vaccine manufacturing in Africa will help attract further investment and tech transfers, paving the way for a robust and self-sufficient vaccine production ecosystem on the continent.

Final thoughts

The journey towards regional vaccine manufacturing in Africa is well underway, with significant strides being made in recent years. However, overcoming the remaining barriers requires continued commitment, innovative solutions, and collaborative efforts from all stakeholders. By addressing these challenges, Africa can achieve a sustainable and resilient vaccine manufacturing landscape, ensuring better health security and access to essential vaccines for its population.